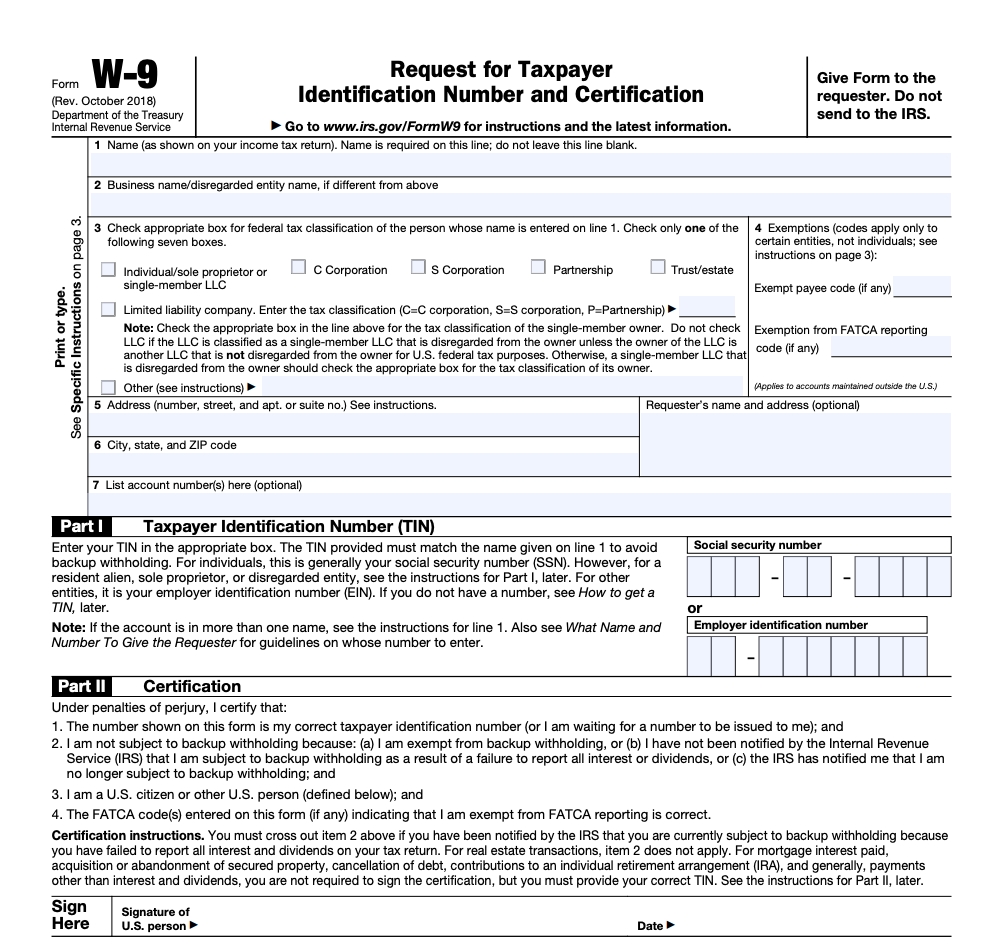

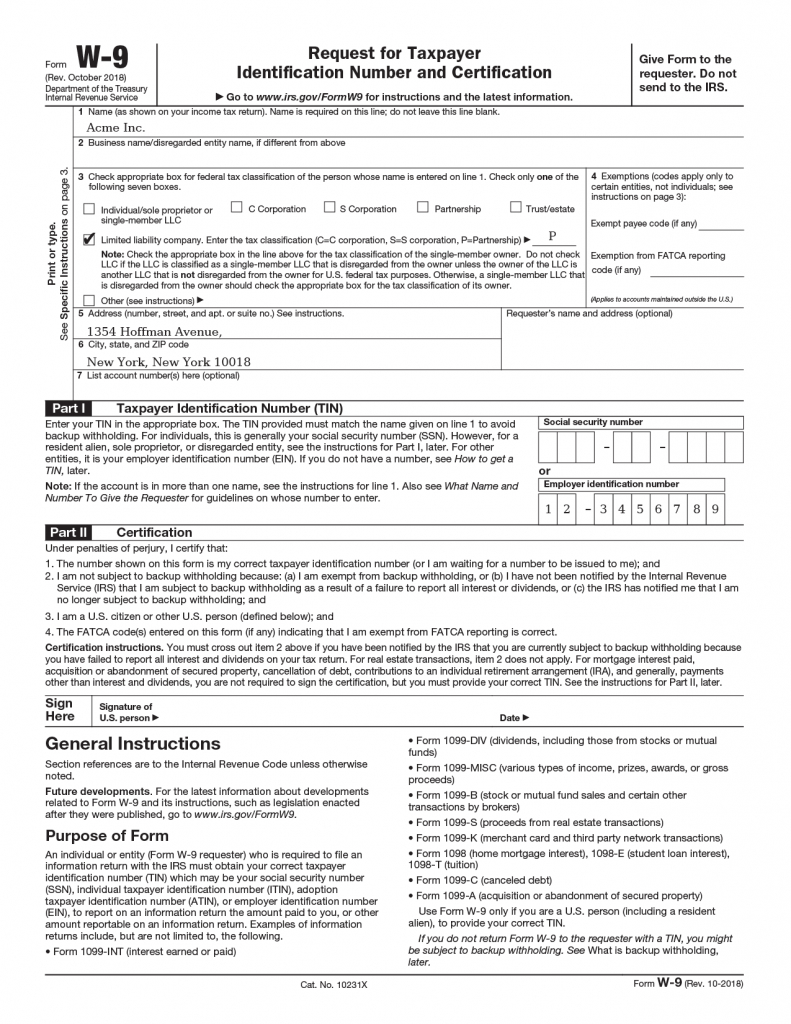

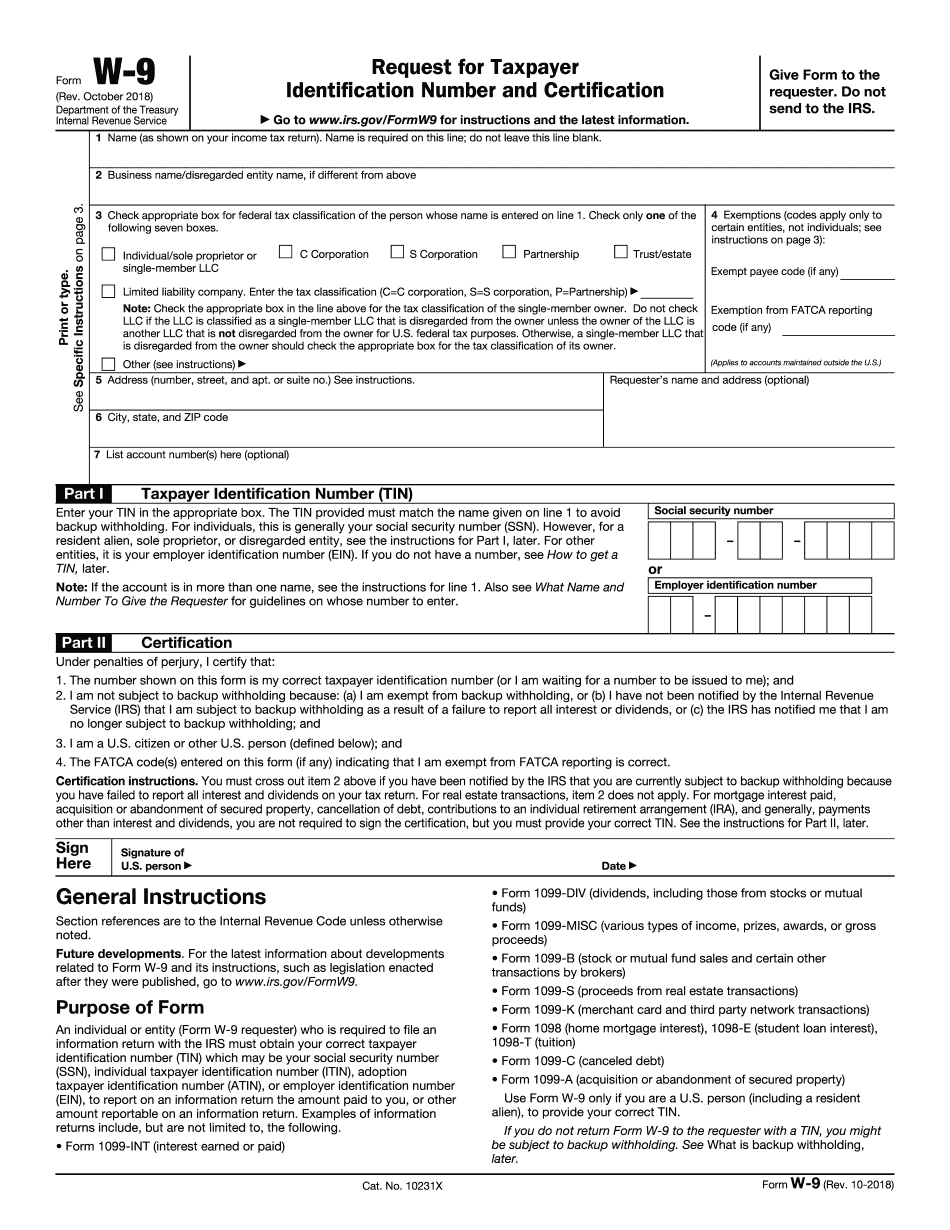

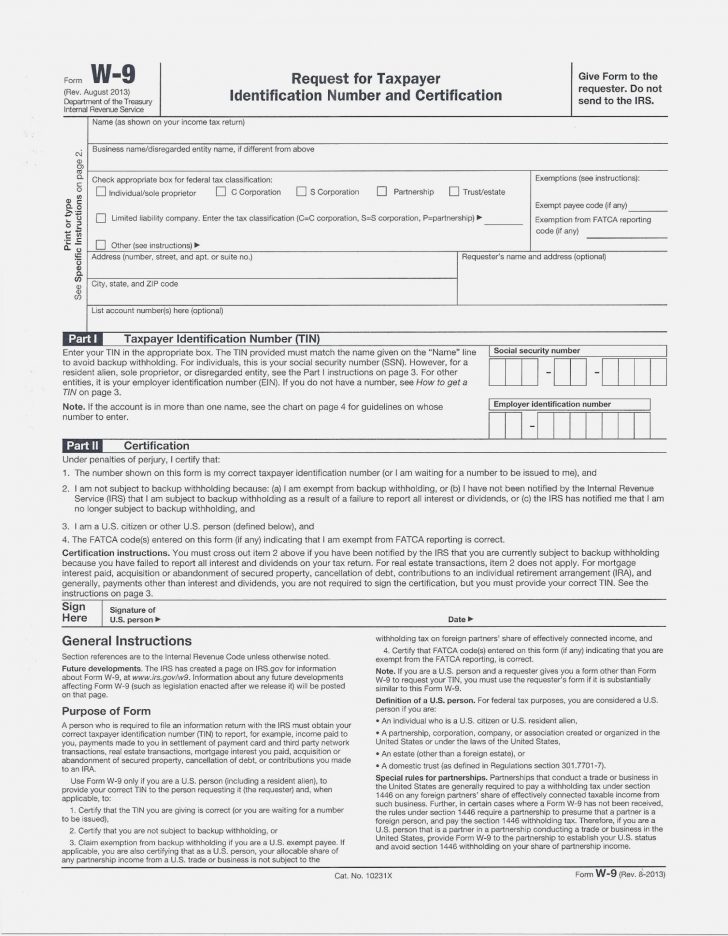

Today, we would like to share some important information with our Asian friends regarding the W-9 form. The W-9 form is a crucial document that is widely used in the United States tax system. It is used to request the taxpayer identification number (TIN) of individuals or entities, such as contractors or freelancers, who are required to report their income to the Internal Revenue Service (IRS).

W-9 Form Overview

The W-9 form, also known as the Request for Taxpayer Identification Number and Certification form, is a simple one-page document. It collects essential information, including the individual’s name, address, Social Security number (SSN), or Employer Identification Number (EIN) for entities. It is essential to provide accurate information on the form to avoid any discrepancies or potential penalties.

Completing the W-9 form is often a requirement for freelancers or independent contractors before they receive payment for their services. This form provides the payer with the necessary information to report any payments made to the IRS at the end of the year.

Completing the W-9 form is often a requirement for freelancers or independent contractors before they receive payment for their services. This form provides the payer with the necessary information to report any payments made to the IRS at the end of the year.

Why is the W-9 Form Important?

For individuals, providing a completed W-9 form is crucial as it ensures that they are correctly identified for tax purposes. It also helps in determining whether tax should be withheld from the future payments made to them.

For entities, the W-9 form is crucial to determine their tax status and prevent any fraud or misrepresentation. It is essential to supply the accurate EIN, which acts as the entity’s identification number for filing taxes.

For entities, the W-9 form is crucial to determine their tax status and prevent any fraud or misrepresentation. It is essential to supply the accurate EIN, which acts as the entity’s identification number for filing taxes.

How to Fill Out the W-9 Form?

Filling out the W-9 form is a straightforward process. The first section requires you to enter your name, which should match the name on your tax returns. If you are operating as a sole proprietor or a single-member LLC, you can use your personal name.

The second section asks for your business name if applicable. It is essential to provide the correct name to avoid any inconsistencies. The third section requires you to select the appropriate federal tax classification for your business.

The second section asks for your business name if applicable. It is essential to provide the correct name to avoid any inconsistencies. The third section requires you to select the appropriate federal tax classification for your business.

Submitting the W-9 Form

Once you have completed the W-9 form, you should sign and date it. As an Asian individual or entity, it is crucial to ensure that your signature matches your legal name. It is recommended to keep a copy of the completed form for your records.

The completed form should be submitted to the requester, typically the organization or individual who will be making payments to you. They will then use the information provided on the W-9 form to generate the necessary tax documents, such as the 1099-MISC, which reflects the income paid to you.

The completed form should be submitted to the requester, typically the organization or individual who will be making payments to you. They will then use the information provided on the W-9 form to generate the necessary tax documents, such as the 1099-MISC, which reflects the income paid to you.

Conclusion

Understanding the importance of the W-9 form is crucial for Asian individuals and entities who are operating in the United States or receiving income from U.S. sources. By accurately completing the form and providing the necessary information, you can ensure compliance with the IRS and avoid potential penalties. Remember, providing accurate and up-to-date information is essential for smooth tax processes and financial transactions.

For further details about the W-9 form, including downloadable templates and instructions, please visit the official IRS website. Remember to consult with a tax professional or advisor if you have specific questions or concerns about your tax obligations.

For further details about the W-9 form, including downloadable templates and instructions, please visit the official IRS website. Remember to consult with a tax professional or advisor if you have specific questions or concerns about your tax obligations.